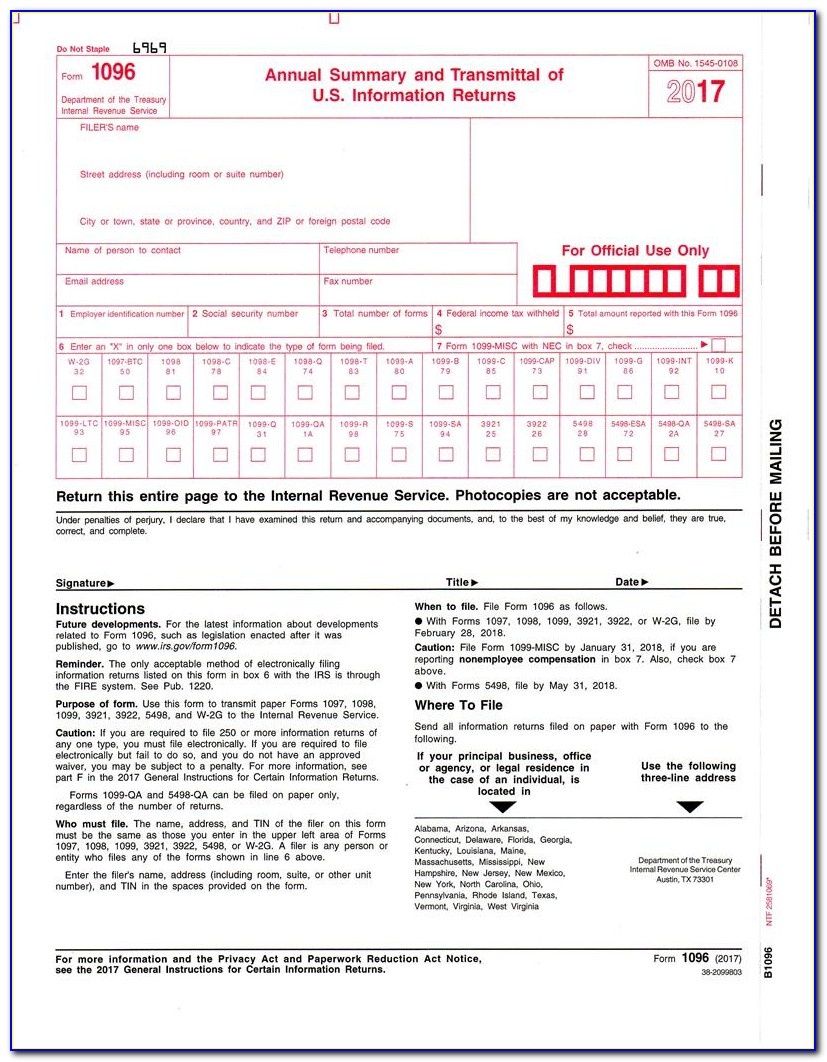

Do not print and use a Form 1096 from the IRS’s website. For example, if you are filing Forms 1099-NEC, mark the box.

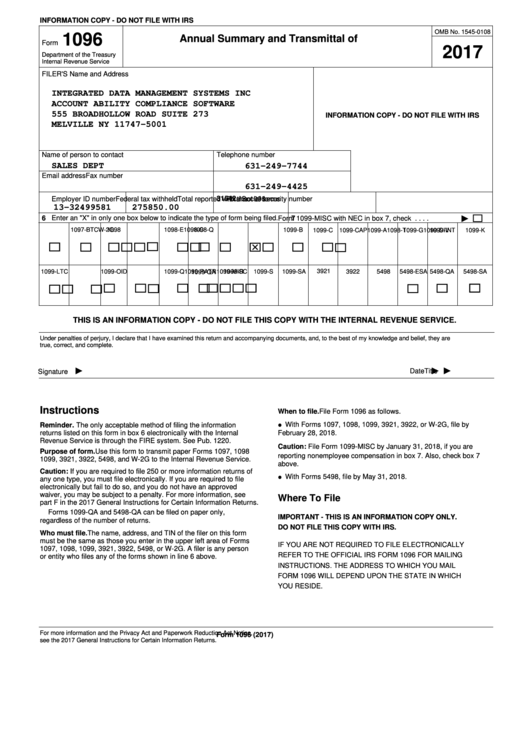

You also need to enter in the total amount of money you recorded on the corresponding information returns.įinally, you will need to mark an X next to the type of form you are filing. Record the total number of forms you are sending with Form 1096. And, you must record your business’s Federal Employer Identification Number ( FEIN) or your Social Security number. Include certain information on Form 1096, such as personal information like your name, address, phone and fax numbers, and email address. And if you need to file 250 or more of a certain type of return, filing electronically is mandatory. Only send Form 1096 to the IRS.ĭo not file Form 1096 if you file information returns electronically. Unlike Form 1099-NEC or 1099-MISC, do not send Form 1096 to independent contractors or applicable state tax agencies. And, you must send it with its corresponding returns to the IRS. You will only prepare it if you need to file one of its corresponding information returns. Filing Form 1096ĭo not file Form 1096 on its own. For example, if you need to give a Form 1099-MISC to 20 people and a Form 1099-DIV to one person, you must prepare two separate Forms 1096 to send to the IRS. You must complete a separate Form 1096 for each kind of return you file.

And like Form W-3, Form 1096 summarizes the payments you made to independent contractors.įorm 1096 is also used to summarize other returns, like Forms 1099-DIV and 1099-INT. Like Form W-2, Form 1099-NEC shows workers how much they were paid. When it comes to reporting nonemployee compensation, you might think of Form 1096 as the independent contractor version of Form W-3, Transmittal of Wage and Tax Statement. In business, Form 1096 is most commonly used to summarize nonemployee compensation (payments made to independent contractors) reported on Forms 1099-NEC.

0 kommentar(er)

0 kommentar(er)